How Well Do You Know Your Home Insurance? Take This Quiz to Find Out!

If you’ve ever thought, “I wish someone would test me on how much insurance lingo I know,” your time has come!

Get out your thinking caps, find a cozy spot, and take this quiz to see how much you know about your home insurance policy. The answers, complete with explanations, are at the end. Terms like “endorsement” and “sublimit” will finally have actual meaning. No peeking! Getting there is half the fun.

Take the Quiz

1. The term “actual cash value” or “ACV” means: A) The amount you paid for an item B) The replacement cost of an item C) The depreciated cost of an item D) The amount you can sell an item for on an internet auction site

2. A “deductible” is the amount you pay out of pocket before your insurance policy starts to pay a claim. True or false?

3. The term “proximate cause” means: A) The immediate reason for an insurance claim B) The root cause of a loss C) The obvious cause of a loss D) All of the above

4. “Loss of use coverage” can help cover living expenses if you have to move out of your house while repairs are made. True or false?

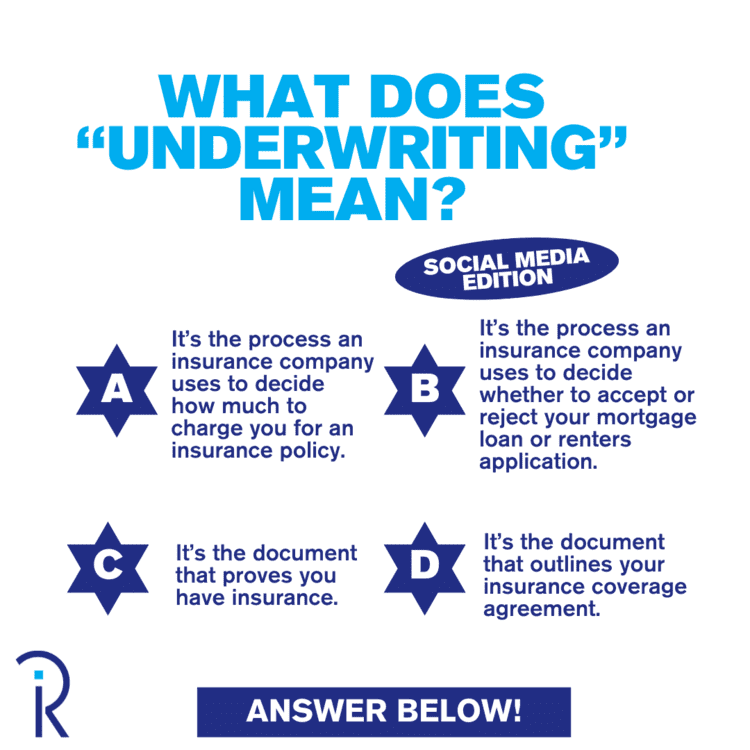

5. What does “underwriting” mean? A) It’s the process an insurance company uses to decide how much to charge you for an insurance policy. B) It’s the document that outlines your insurance coverage agreement. C) It’s the process an insurance company uses to decide whether to accept or reject your mortgage loan or renter’s application. D) It’s the document that proves you have insurance.

6. “Personal liability protection” includes protection for which of the following events? A) Unintentional property damage and injuries that you cause B) Medical expenses for you and your family members C) Damage to your personal property and belongings D) Intentional property damage and injuries that you cause

7. The “Insured” on a policy refers to the insurance company. True or false?

8. An insurance policy “exclusion” means: A) Dangers or damages covered by the policy B) Dangers or damages not covered by the policy C) The maximum amount the insurance company will pay for a claim D) Dangers or damages the insurance company promotes for exclusive policyholders

9. What are “special limits of liability” or “sublimits” in an insurance policy? A) The maximum amount a policy will pay for certain types of property or losses B) A special discount the insurance company gives clients with good credit C) The total amount a policy will pay for every claim you have during your policy term D) A special discount the insurance company gives clients for being underinsured

10. A “rider” or “floater” means: A) A way to cover other people who drive your vehicle B) Additional insurance coverage for high-value items you own C) A discount that reduces the policy costs D) Coverage for pest infestations

11. What is a “peril”? A) The location of your property B) The actual cash value of your home C) The danger that causes loss or damage D) The amount you have to pay after your insurance pays for a claim

12. “Aggregate limits” refer to the most your insurance will pay for all claims during the policy period, regardless of your policy limit. True or false?

13. What is an “endorsement”? A) A company that recommends the policy B) A change or addition to your standard insurance policy C) A claim submitted to the insurance company D) A person who vouches for you when you have a claim

Answer Key, With Explanations

1. C. Actual cash value (ACV) is the depreciated cost of an item, not its replacement value. 2. True. A deductible is the out-of-pocket amount you pay before your insurance kicks in. 3. D. Proximate cause is the root event that leads to a loss—a key factor in claims. 4. True. Loss of use coverage pays for living expenses if your home becomes unlivable due to covered damage. 5. A. Underwriting is how insurers evaluate risk and determine pricing. 6. A. Personal liability protection covers unintentional property damage and injuries you cause. 7. False. The “Insured” is you. The insurance company is the “Insurer.” 8. B. Exclusions are specific risks or damages your policy doesn’t cover. 9. A. Sublimits cap how much your policy pays for specific types of property or losses. 10. B. A rider provides extra coverage for high-value items like jewelry or electronics. 11. C. A peril is a danger or risk that causes damage, like a fire or theft. 12. True. Aggregate limits cap what insurers pay for all claims during your policy term. 13. B. An endorsement modifies your existing policy, often adding or adjusting coverage.

How Did You Do?

Did you ace it, or were there a few surprises? No matter how you scored, understanding these key insurance terms can help you better navigate your policy and ensure you have the right protection in place. Have questions? Reach out to Rathbun Insurance—we’re always here to help you understand what matters most!