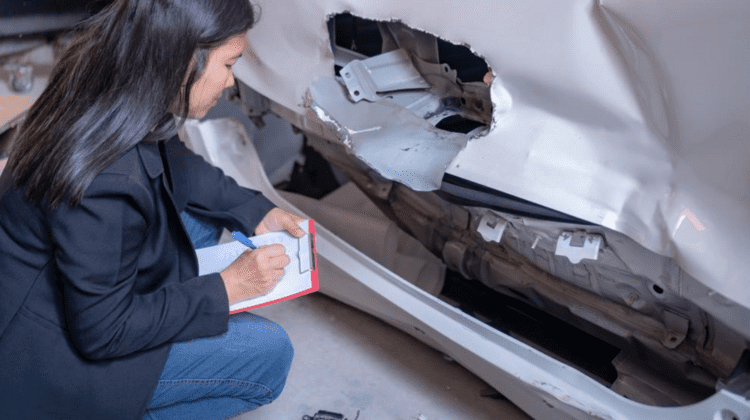

A claims adjuster determines how much your insurance company should pay you after you file a claim. A property and casualty adjuster investigates auto, business and home claims. They're also called an insurance adjuster.

Claims adjusters may handle property claims involving damage to vehicles or structures, or liability claims involving property damage or personal injuries to others. They have many tasks, depending on the type of company they work for. But they typically investigate, evaluate and settle insurance claims.

Three types of insurance claims adjusters

There are three different types of claims adjusters.

Staff adjuster: Staff adjusters work full time for one insurance company. Generally, they are salaried and receive benefits, such as life and health insurance, and continuing education. Staff adjusters respond only to claims for the insurance company they work for.

Independent adjuster: Independent adjusters contract with multiple insurance companies or adjusting firms. They often work on catastrophe claims and travel to affected areas after major weather events or emergencies.

Public adjuster: Public insurance adjusters work directly on behalf of policyholders. They help businesses or individuals with insurance claims if a proposed settlement is unacceptable.

Claims process

Adjusters research your insurance policy to determine the amount the insurance company should pay. They prepare a report about your claim to present to the insurance company. This is also known as a "claims file." Sometimes they conduct surveillance and investigations to ensure the claim is not fraudulent.

A claims adjuster may investigate your claim by:

- Speaking to you, the claimant

- Inspecting the damage and taking photos or videos

- Interviewing any witnesses

- Researching records, such as police or medical records

- Consulting with experts, such as physicians or roofing professionals

Once the investigation is complete, the adjuster determines how much the insurance company should pay for your loss. They report their evidence to a claims examiner, who ensures guidelines are properly followed.

The adjuster then negotiates with you, the policyholder, to arrive at a final payment amount for the claim.

Getting you back on your feet

Insurance adjusters help people in the aftermath of a loss, whether it’s a natural disaster, an accident, a theft or something else. Often, the claims adjuster is one of the first people who reach out to assist you after a loss.

Automation is evolving to streamline the process

While claims adjusters do most of the work on all types of claims at most insurance companies, some companies now use technology and artificial intelligence to automate parts of the claims process.

For example, you may be able to submit a simple claim online or through a smartphone app. A chatbot may rapidly review the claim, cross-reference it with your policy, run anti-fraud algorithms, send fund wiring instructions to the bank, and inform you the claim has been closed.

Do you need to file an insurance claim?

Your Rathbun Insurance account manager can guide you through the process and answer any questions you have about working with the adjuster assigned to your claim.